How to Void a Check

Using a “VOID” stamp on a check is a great way to stop a payment from being made. Whether you are using a physical check or direct deposit, you will find that writing a “VOID” on the check will help you avoid payment.

Stop payment on a check

Having a stop payment on a check can help you avoid a potential overdraft fee. But, it is important to understand how these types of payments are processed and what the fees are.

The first thing you need to do is to contact your bank. Some banks will allow you to do this online, while others may require you to send a written request. This request should include information about the check you want to cancel, such as its number and the amount. You can also use the bank’s mobile app if it offers one.

You can also contact your bank in person to report fraud. Some banks offer free stop payment services for a limited time. You can also report fraudulent checks to the Office of Comptroller of the Currency, which is the agency responsible for investigating bank fraud. If you’re unsure whether a check is fraudulent, you can also check the transaction history to find out. If you suspect fraud, contact the bank or merchant immediately and notify them of the error.

You may also have to pay a fee to cancel a check. Some banks will waive this fee, while others will charge $30 or more. You will need to check the policies of your bank and decide whether the fee is worth it. Some premium checking accounts will also allow you to avoid this fee. However, you will also need to prove your right to stop a check before the bank will cancel it. If your bank does not allow you to stop a check, you should contact a local financial attorney.

Stop payment orders typically last for six months. Some banks may allow you to renew the order for an additional fee. You may be able to place a stop payment on a lost check or on a series of checks. But, the process is a bit different than it is for cashier’s checks. If you have a cashier’s check, you can expect the funds to be processed immediately.

You may also be able to place a stop payment if you’re missing a payment. You can do this by contacting your bank or credit union. This is a multi-step process, and it takes time and operational work. You can also place a stop payment by using your bank’s online banking platform. You will also need to provide a written request within 14 business days.

It is also important to remember that your stop payment on a check can last for 24 months. If the check is cashed, you will have to pay the check’s cost and the fee for the stop payment. The bank can also accidentally cash your check after you have placed a stop payment. This can cause financial damage to the bank and the payee.

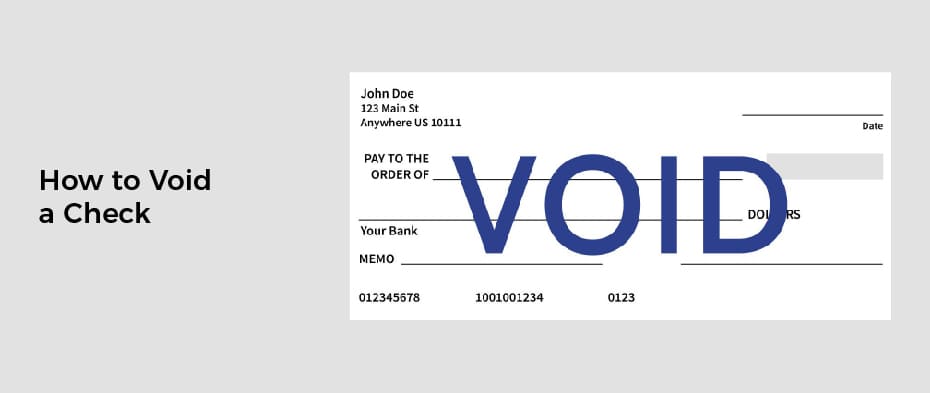

Write “VOID” on the check

Whether you have a mistake while writing your check or you want to set up an automatic transaction, you may need to write “VOID” on the check. Void checks are usually written in large letters or smaller letters across the check’s face. However, they should not be over the check’s routing number or account numbers.

VOID checks are not to be used for cashing out or for writing money. Instead, they are only to be used for payment purposes. The number at the bottom of a void check is used by the recipient to establish a link with their bank account. This is important for verification purposes. Often, banks will send a preview of the check when ordering online. It is important to note that some banks will charge a fee for voiding checks.

Void checks are often used in direct deposit transactions. A void check can be used to set up an automatic transaction that will deduct money from your checking account on a regular basis. It can also be used to verify bank information. Employers sometimes use void checks to verify the banking information of their employees. They will also ask for a copy of a voided check when setting up direct deposit. You can also print out a copy of your void check to keep for future reference.

You should also be aware that the number at the bottom of a void checks can be used by a thief to make a new check payable to themselves. This can be dangerous because thieves can deposit the money into a real bank account. If you want to avoid this from happening, you should write the number on the check in a different location. You should also keep a copy of the check for at least 14 days.

You can also write “VOID” on the check if you want to stop a payment from being deducted from your account. Some banks allow you to send a void check to your bank via encrypted PDF, which prevents unauthorized viewing of your check. However, you must be aware that there is a risk of unauthorized access to your information if you send it via email.

You should also note that writing “VOID” on the check can help prevent theft. Thieves will not be able to write on the check and will not be able to cash it. If you don’t want someone to use your check to make a payment, you should never give them a blank check.

If you have to write a void check, make sure to write the number on the check in a permanent ink. This is important because it will prevent the number from being erasable. You can also write “VOID” on a regular check line, but be careful not to write over the number or account number.

Establish direct deposit without voiding a physical check

Getting paid by direct deposit can save you a lot of time and money. This is because it allows you to receive your paychecks in your checking account rather than having to go to your bank to get them. Using this service also means that you don’t have to worry about cashing a check or having to worry about it being stolen. In fact, you can even set up auto payments for your bills.

In order to set up direct deposit, you will need to provide your employer with some key information. This information includes your bank’s routing number and your bank’s account number. You may need to provide a voided check as well, depending on the company you work for. A voided check is a legal paper check that contains all of the important information. In addition to the routing and account numbers, the voided check contains the account owner’s name, the account number, and the bank’s mailing address.

Providing your employer with the correct information can make the process of setting up direct deposit a lot easier. Some employers require that you provide a voided check, while others will give you a physical check until the direct deposit process is set up. You can also talk with your bank to get the process started. If you don’t want to use a voided check, you can try using a blank check to set up automatic payments for bills or loans. However, this method is more cumbersome than using a blank check, so make sure you’re using the correct pens and a good quality printer.

The routing number is the most important part of a direct deposit form. This number will allow your employer to verify that you have a valid account at your bank. The routing number is nine digits long, and can be found on the bottom left hand corner of your check. The routing number can also be found on your bank statement. It’s also important to note that the routing number is different for each bank, so it’s important to ensure that you are providing the correct information.

A money market account is a type of bank account that tracks cash and cards. These accounts can be used for bill payments and money transfers, but they don’t offer the same checking features as a savings account. You can set up direct deposit and receive money in your money market account, though.

The most important information in a direct deposit form is your bank’s account number. The account number is found to the right of the routing number in the lower left hand corner of the check. If you haven’t set up direct deposit yet, it may take weeks for your paychecks to reach your bank account.